By Anne Montgomery and Sarah Slocum

On May 4, 2018, the Michigan State Legislature voted to “just do it:” to assemble a group of experts to craft a blueprint for taking the Wolverine State deep into the future of Michigan’s age wave – all the way through the mid-21st century.

Specifically, the language requires the Michigan Department of Health and Human Services (MDHHS) to contract for: “an independent feasibility study and actuarial model of public, private, and public-private hybrid options to help individuals prepare for, access, and afford long-term services and supports.” The study will take 9 months. It is meant to squarely address the fact that current options for individuals to fund their long term supports and services (LTSS) needs have been unworkable and have often resulted in impoverishment and bankruptcy for Michigan families.

Since Medicare doesn’t pay for LTSS and less than 10% of Americans have purchased private long term care insurance, most people have to pay out-of-pocket when they need in-home care, assisted living, or nursing home care. This continues until the disabled person qualifies for Medicaid, which picks up the cost of nursing home care. Or, if there is an available program for home and community-based services (HCBS) that doesn’t have a waiting list, families may be able to tap into Medicaid for in-home services and other types of assistance.

Along the way, thousands of formerly middle-class families in Michigan are forced to impoverish themselves every year in order to qualify for Medicaid LTSS coverage. This “spend down” process is anguishing for many, who would prefer to have more control over their lives and perhaps to leave some of their accumulated resources to children and grandchildren. Recognizing this, the Michigan legislature, led by Rep. John Hoadley (D-Kalamazoo) and Sen. Margaret O’Brien (R-Portage), went to work last year — along with a coalition of concerned organizations led by Michigan United and including Altarum’s Program to Improve Eldercare – to ensure that the study bill would become law.

The Michigan budget for fiscal year 2019, which begins in October, includes language directing the Department of Health and Human Services (MDHHS) to draw up a workable, practical plan that will make LTSS available to middle-class Michigan families. MDHHS has $100,000 in state funds that will be matched with at least that much in private philanthropic funds – and possibly far more — to take a hard look at LTSS financing possibilities, workforce development capacity and future needs. The study will assess the current landscape of long-term care needs including:

- What private and public services exist;

- What the costs for current services are;

- Who is accessing them and who is not;

- What are the challenges to accessing care, including the gaps in services;

- The impact that care has on the care workforce and family caregivers.

- The primary goal of this study is to assess the cost and impact of three main financing proposals:

o A long-term care benefit for all Michiganders;

o A public-private risk-sharing insurance program that reimburses insurers;

o A long-term care benefit for those who do not qualify for Medicaid.

Today, Michigan Medicaid spends almost $3 billion per year on LTSS — and the cost goes up each year. But Michigan families spend more. AARP Michigan reports that Michigan families provide $15 billion worth of uncompensated care each year. New options are needed to keep both the state budget and Michigan families healthy during the state’s “age wave” era.

On the workforce side, Michigan is already facing shortages of people able and willing to fill direct caregiving jobs. MDHHS will engage experts to examine what supports current workers need to remain in the LTSS workforce: e.g., career ladders, benefits and wages to make LTSS jobs more attractive, and workplace conditions to make LTSS jobs safer and valued to attract candidates and keep them. Overtime and turnover due to stressed staff are major cost centers and major causes of staff shortages. The LTSS study will examine all of these factors and create new solutions to make LTSS jobs a career option for many more people.

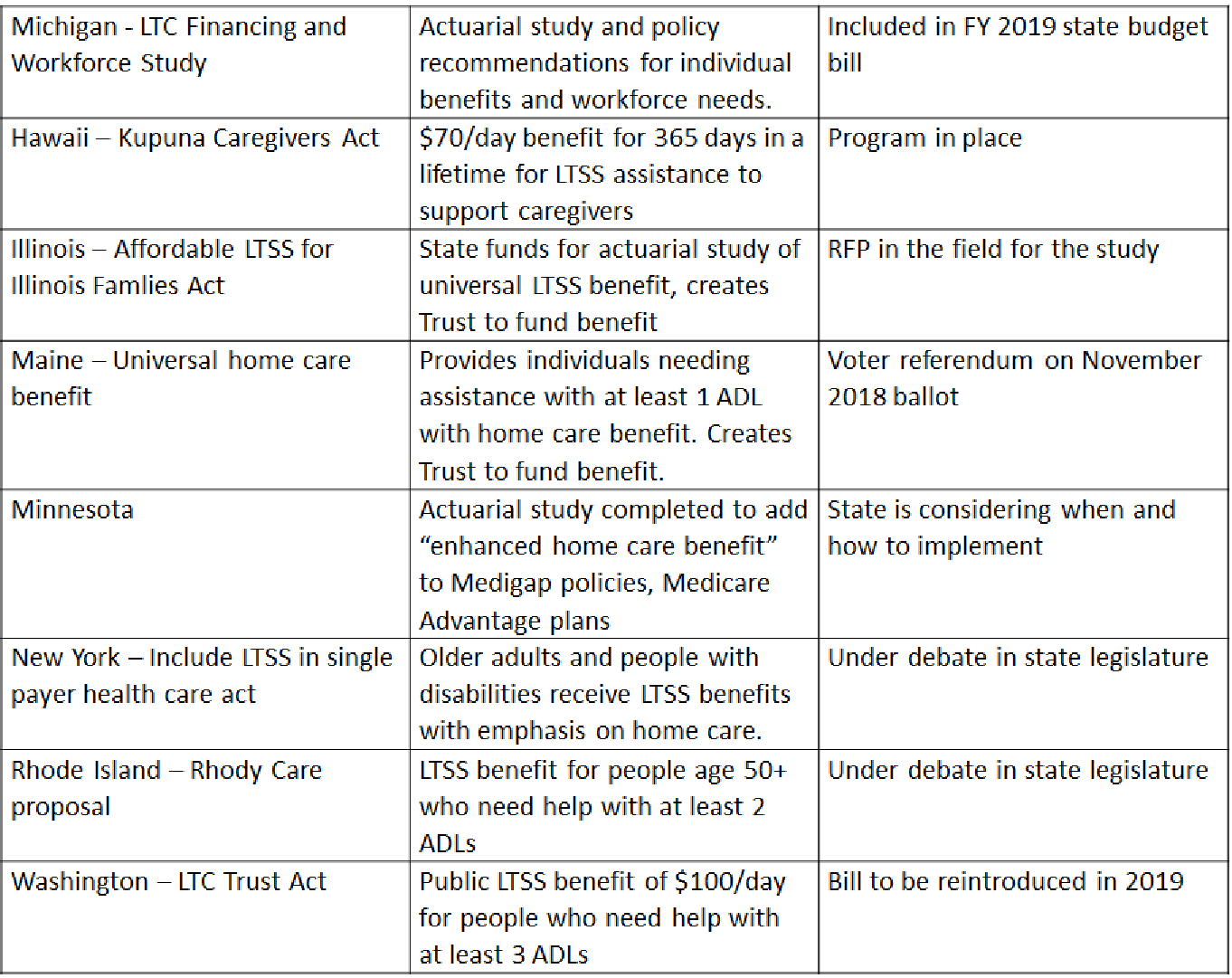

Similar studies in the states of Washington and Hawaii have resulted in major changes to how LTSS is delivered and paid for in those states. The AARP Long Term Supports and Services Scorecard ranks these states respectively first and seventh in the nation on an array of measures. Washington and Hawaii have used results of LTSS studies to develop much better options for individuals and workers. Michigan is overdue for a serious examination of issues in financing and staffing LTSS, and this opportunity will jump-start major innovations. In the absence of a national strategy or plan for affordable high quality LTSS, several additional states are pursuing state level action. The chart below provides some current examples:

The current environment of long term care in Michigan includes over 40,000 nursing home beds in about 430 facilities, another 40,000 beds in about 4,500 Adult Foster Care Homes, and 10,000 beds in about 190 Homes for the Aged. An unknown number of unlicensed Assisted Living facilities operate in Michigan, serving an unknown number of people. In addition, another unknown number of people are getting care through visiting nursing services, private duty home care, and other unlicensed businesses offering various services. Medicaid also funds 11,000 Medicaid HCBS beneficiaries through the “MI Choice” program, and over 3,000 beneficiaries (the vast majority are dually eligible) through 10 PACE organizations (Program for All Inclusive Care for the Elderly). Michigan is home to nearly 1.9 million Medicare beneficiaries, of whom almost 300,000 are also eligible for Medicaid.

Experts estimate that 50% of the Medicare population will need long term care at some point in their lives. In Michigan and around the country, elders are the fastest growing segment of our population – so the need for LTSS, which seems high today, is set to increase steeply over the coming years.

To put some financial parameters around this discussion, nursing home care costs Michigan’s Medicaid budget $1.7 billion dollars per year; private pay rates in nursing homes range from $9,000 to $11,000 per month. Adult Foster Care and Home for the Aged monthly rates range from $800 to $5,000 for those able to pay privately. Michigan spends another $350 million on MI Choice and PACE, both of which have lower monthly costs than nursing home care. Area Agencies on Aging and other community organizations provide supportive community services, but their budgets are quite limited and have not seen the significant budget increases needed to keep pace with the growing aging population.

The costs to individuals and families of unplanned, poorly coordinated LTSS are also very high: First there are substantial “out-of-pocket” costs associated with in-home services, equipment, medications and more medical procedures and visits; second are the high costs to family caregivers, who may face the loss of their jobs and their own livelihoods as care needs increase. Some families may also find it necessary to move to different housing that can accommodate an ill or disabled family member’s needs for disability access, thus incurring the costs of moving. Many families struggle and figure out how to cope for a while, and later give up – leading to costly nursing home admissions. Others simply go bankrupt.

Like other states, Michigan must devise ways to stretch publicly financed health care dollars further to support LTSS. For families, LTSS must be made more affordable and reliable – and delivery systems must shift to services that can readily be delivered at home. The workforce that delivers this care must be well-trained, supported, and paid a living wage to assure quality and continuity of services. With advocates, researchers, policymakers and funders at the table, the Michigan LTC study is a prime opportunity to create smart adaptations to existing programs, and to create new and more efficient initiatives. Both will serve as investments in the future.

THANK YOU, THANK YOU, THANK YOU, for including EQUIPMENT as a cost that needs to be included in any study of out-of-pocket costs. Hope you will be open to a friendly suggestion. PLEASE think about data points that support a “what-if” approach to investigating the “Return on Investment” that “right equipment” can bring to a health system.

Such an approach may discover that covering the costs of more expensive devices that demonstrate improved independence for those aging with mobility-related disabilities can reap savings in the form of reduced ED visits due to falls, reduced hospitalizations due to fewer adverse events arising from unmet need for assistance, and capacity to live independently rather than have to cope with institutionalization.

Willing to assist anyone who is curious about this. Work from Beer, King, Freedman provides insights into how to proceed.